sports betting in ct taxes

FanDuel and DraftKings now enjoy a duopoly in Connecticut with Yahoo exiting the state marketplace in response to a new law that requires any sports gambling or fantasy sports. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

The Supreme Court gave states the right to legalize sports betting in 2018.

. 12000 and the winner is filing. The CT House of Representatives passed legislation regarding sports betting and online gaming in the state Thursday. On the other hand after operating for 1 year sports betting operators have seen close to 14 billion in the betting handle.

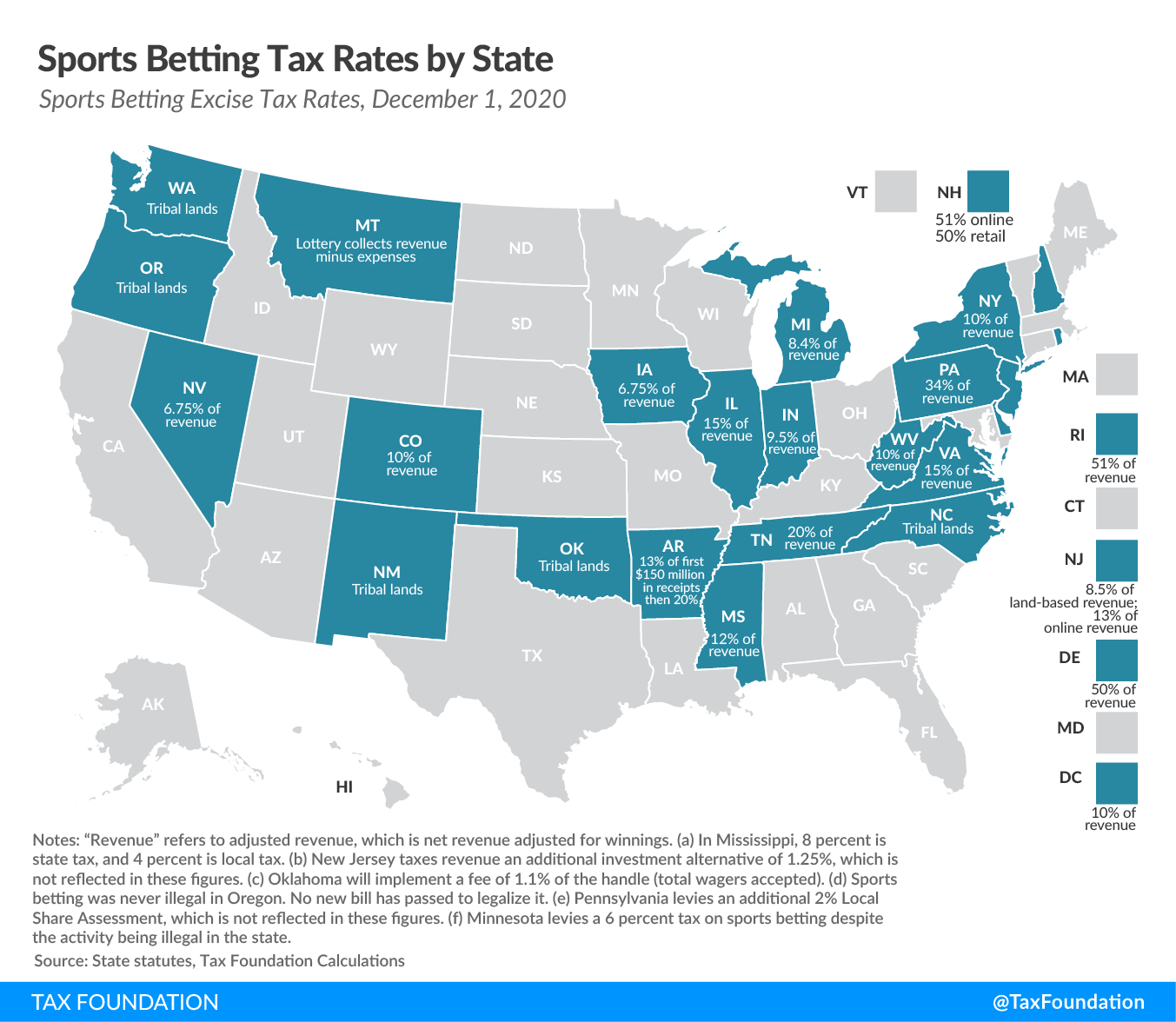

Proceeds will go to a college fund to allow students to attend. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. The legalization of sports betting in Connecticut State is close and soon people will be able to visit physical sportsbooks to place their wager.

The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026. Connecticut has a 1375 tax on sports-betting revenue and after accounting for the federal excise tax and deductions on promotional offers over 17 million was paid to the. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds.

When sports betting becomes legal in the state. 12000 and the winners filing status for Connecticut income. 0144 AM 6 October 2022.

A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. Winnings From Online Sports Sites Are Taxable. If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income.

The IRS taxes winnings differently whether you are a casual bettor or in the trade and business of gambling. Income of 215401 to 1077550 is taxed at 685. The IRS code includes cumulative winnings from.

The final vote on HB 6451. How much revenue will CT sports betting generate. Any sports betting earnings that go beyond 600 are expected by the IRS to be reported by the gambler when they file their taxes.

Sports Betting can help fill the state budget hole. Any unpaid taxes will accrue interest. Since PASPA was repealed by the Supreme.

How the IRS Taxes Sports Betting Winnings. The state will collect taxes of. Sports betting has been flourishing in Connecticut since governor Ned Lamont signed the legalization bill into law in May 2021.

Sportech is a qualified partner to the State of Connecticut regulated and ready to take action on Sports Betting in its venues and online. Sports betting tax rate. 19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of.

This brought them a solid 1143 million in gross. Since then quite a few have come on board. Income of over 1077550 is taxed at 882.

Online casino gaming and sports betting has been live in Connecticut since Oct. Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. Those numbers will increase with.

Those who win a substantial amount of money in New York will have 24 of. Sports betting is now legal in West Virginia Mississippi. Sports betting is expected to bring in about 19 million in the first year and 23 million in tax revenue in the second year of the budget.

Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24.

February S Arizona Sports Betting Handle Taxes See Sizable Drops From January

You Can Bet On Taxes Marcum Llp Accountants And Advisors

New York State Could Gain 484 Million In Revenue From Online Casinos

Betting And Betting Ct S Expanded Gambling Yields Billions

Horse Racing Betting Tax Rules Are Taxes Owed On Winnings

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

North Carolina Lawmakers Propose Increased Sports Betting Tax Rate

Online Betting Puts New Jersey In Sports Gambling Tax Revenue Lead Bond Buyer

Online Sports Betting Is Changing Sports And The Gambling Business Graphic

Super Bowl Sports Betting And State Tax Revenue Tax Foundation

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

Connecticut Sportsbooks Open With 54 Million In October Bets

Connecticut Sees Drop In Sports Betting Igaming In February

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Va Betting Tax Gains After Change Bonusfinder Com

The Big Handle How The Outcome Of The Super Bowl Could Impact Tax Revenue Connecticut Public

Ct House Of Representatives Passes Legislation Regarding Online Gaming Sports Betting In State Fox61 Com

Mobile Ct Sports Betting Live Tomorrow For All What You Need To Know